child tax credit portal for non filers

Filed a 2019 or 2020 tax return and. Some of the credits will be distributed through monthly payments.

Child Tax Credit Update Irs Launches Two Online Portals

To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have.

. Get started First you make a new account with the Non-filer Sign-up Tool for 2021. The IRS plans to launch a portal this month that will allow non-filers to input their information in order to claim the Child Tax Credit. Up to 500 for children aged 18 as well as those aged 19 to 24 who are also full-time students.

Child Tax Credit Update Portal. And now its becoming more accessible than ever. Ad The new advance Child Tax Credit is based on your previously filed tax return.

TikTok video from The News Girl lisaremillard. Individual taxpayers can call the IRS helpline at 800-829-1040 from 7 am. The IRS now has an online portal to allow people who dont file tax returns to register for the credits.

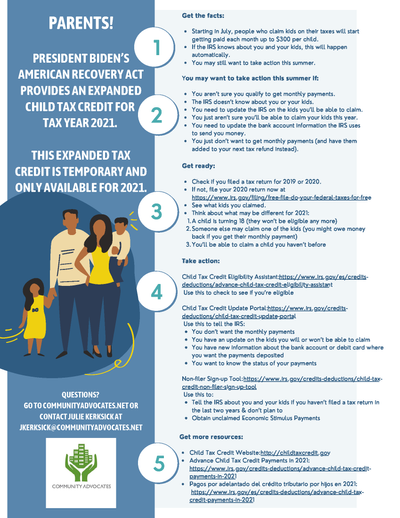

You may be eligible for Child Tax Credit payments even if you have not filed taxes recently. June 14 2021. Families including those who received part of their Child Tax Credit as monthly payments last year can get their remaining Child Tax Credit by filing a.

Local time for telephone assistance. This year Americans were only required to file taxes if they. Then enter the User ID and.

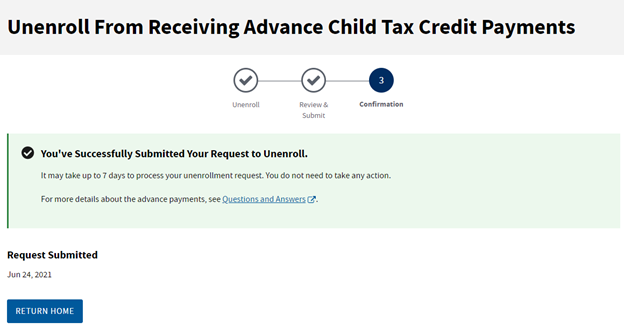

The Child Tax Credit Update Portal is no longer available. See below for more information. This tool times out aer 20 minutes.

Who is Eligible. People who received advance CTC payments can also check the amount of their payments by using. WASHINGTON The Treasury Department and the Internal Revenue Service today unveiled an online Non-filer Sign-up tool designed to help.

Its called the Non-filer sign-up tool which is for people who did NOT we repeat DID NOT file their 2020 taxes which would have been done in 2021. The White House has put a temporary pause on the IRS Child Tax Credit tool Politico reported on March 3. The IRS Non-filer Sign-up Tool offers a free and easy way for eligible people who dont normally have to file taxes to provide the IRS the basic information.

The Child Tax Credit will also be fully refundable this. THE IRS has opened an online portal allowing non-filers to register information to receive the 3600 child tax credit when first payments are issued on July 15. You could get up to 3600.

According to the tax agency the Child Tax Credit portal was built. Opening the Child Tax Credit up to non. After you file or register you can use another tool to monitor or manage your monthly payments.

Not everyone is required to file taxes. The agency offers interpreters in more than 350. The enhanced child tax credit payments are only set to last through 2021 but President Biden has suggested that this may be extended through.

Childtaxcredit MONDAY DEADLINE to sign up in the non filers portal on irsgov if you want. If you received any monthly Advance Child Tax Credit payments in 2021 you need to file. The other half of the tax credit can be claimed after filing a 2021 tax return.

File a free federal return now to claim your child tax credit. The Child Tax Credit Update Portal. Your remaining credit.

Ad The new advance Child Tax Credit is based on your previously filed tax return. Because of a recent law more families qualify for and will get money from the Child Tax Credit CTC even those that dont have recent income. File a free federal return now to claim your child tax credit.

Up to 3000 for children aged 6 to 17. The Child Tax Credit Non-Filer sign-up tool requires users to enter their identifying information. If that happens just click Sign In.

These people can now use. The Child Tax Credit for tax year 2021 is up to 3600 per child under 6 and 3000 per child age 6-17. Filing taxes is how you receive Child Tax Credit payments that you are owed for 2021.

The Child Tax Credit is worth a lot of money this year. 37K Likes 211 Comments. The non-filer portal tool was for people who do not earn enough money to file tax returns to register for the remaining money from the child tax credit.

That meant if a family claimed the 2000 credit for a single child and owed no money to the IRS the most that family could get back in refund form was 1400. IRS Child Tax Credit Portal for Non-Filers Is Open for Business. IR-2021-129 June 14 2021.

You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021.

/cloudfront-us-east-1.images.arcpublishing.com/gray/NTFOD5O45ND3FNB4WAUKZX5ZHE.jpg)

Irs Says Portal Now Open To Update Banking Info For Child Tax Credit Payments

November 15 2021 Deadline For Non Tax Filing Families To Use Child Tax Credit Portal Lone Star Legal Aid

What Is This Thing Called Portal

Child Tax Credit What We Do Community Advocates

Turbotax Irs Launch Online Portal For Stimulus Check Direct Deposit

Assisting Non Filers With The Child Tax Credit Ctc Better Health Together

Families Receiving Monthly Child Tax Credit Payments Can Now Update Their Direct Deposit Information The Georgia Virtue

Irs Unveils Online Tool To Help Low Income Families Mychesco

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

It Took Two Days To Make A Good Ctc Website People S Policy Project

The Child Tax Credit Non Filer Tool Is A Mess People S Policy Project

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Online Filing Portal Is Open Again Nstp

Tas Tax Tip Ten Things To Know About Advance Child Tax Credit Payments Taxpayer Advocate Service